“Everybody in the world is a long-term investor until the market goes down.” – Peter Lynch

Hi all,

As you may know, we were looking for a “snapback” rally after the S&P 500 had dropped over 21% from its all-time high on February 19th until April 7th. Since then, we’ve seen a 23% rally off those low prices, and we now sit about 3% of the way from all-time highs on the S&P 500, and most portfolios are now slightly positive on the year.

Sitting through the decline, even with the knowledge that a bounce was inevitable, is never easy. But these are the times when having a professional manage your money and your emotions is invaluable. I’d like to think that we’re going to side-step a recession in the coming months and finish the year markedly higher than we are right now, but we’re not quite ready to make that call just yet.

Let’s take a look at some of the bigger headlines, and how we see the next few months playing out.

- Moody’s Credit Downgrade

Moody’s downgraded the U.S. government’s credit rating for the first time since 1917. While this may evoke some memories of when S&P Global did the same thing in 2011 (the S&P 500 was down 6% the next day), the move itself is much more symbolic than earth shattering. At the time, in 2011, the possibility of a credit downgrade was unthinkable, but mostly disturbed pensions, endowments, and large institutions that were forced to only purchase AAA rated securities by their investment policy statements. This led to major short-term volatility, but since those problems were addressed over a decade ago, we don’t see the same thing happening again. The future concerns over stable or rising interest rates in the face of a deteriorating housing industry and a ballooning (and going higher) national debt are the larger issues to keep in mind.

- Tariffs and Geopolitics

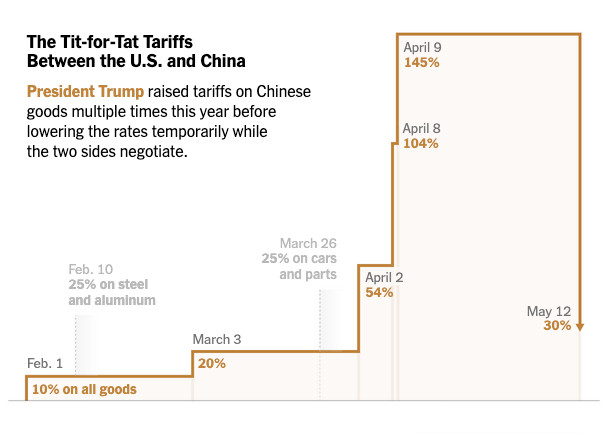

I know I’ve told most of you this but the Trump 1.0 playbook for negotiations was relatively simple. Create Crisis –> Expand Crisis –> Remove Crisis –> Declare Victory.

As you can see from the chart above, this time was no different. The market’s response (and it was a logical one) was that 50%-150% tariffs on Chinese imports was effectively an embargo on all Chinese goods. The potential seizure of global trade markets sent both sides into a tailspin and investor’s expectations and imaginations went along for the ride. Now that cooler heads have prevailed (most notably Treasury Secretary, Scott Bessent), the reality of the situation is that 30% tariffs are better than 145%, but worse than initial levels of 2025. This has all been a net negative, but it will be far less net negative than it could have been. The million dollar question remains whether the consumer can stay resilient enough to weather the storm, and how much of the added corporate tax (that’s what tariffs are) gets passed along to consumers.

- Stock Market Internal Strength

It’s very true that the largest percentage moves in the stock market come in bear markets. The question here is now whether the rally we’ve seen is a “bear market rally” and stocks are destined to revisit their April low prices, or have we started a new uptrend? The chart above says, all-time highs are highly likely over the next 12 months, as the market triggered one of my two favorite market signals in late April, the Zweig Breadth Thrust. Essentially, this occurs when the market moves from a deeply oversold condition, into a strongly overbought one, in a short period of time. Since WWII, this signal has triggered 20 times, including this one. The S&P 500 was higher a year later 19 out of 19 times, with an average one-year gain of 23.4%. If you want to ignore history, or what’s actually happening in the stock market, that’s up to you. There are no holy grails in investing, but this one is as close as it comes.

The major takeaway should not be that stocks will immediately move to all-time highs, but with the added confidence and likelihood of higher prices over the next 12 months, we are looking to put extra cash to work on any significant dips (monthly contributions, rollovers, excess dividends).

– Adam