“It’s no wonder that truth is stranger than fiction. Fiction has to make sense” – Mark Twain

For this month’s commentary, let’s try and unpack some of what’s going on.

Market participants are all asking three questions.

- Will inflation/prices come down?

- How high will the Federal Reserve raise rates?

- Will there be a recession?

Respectfully, these are not the things that matter. We can’t know the answers to these questions, and even if we knew the answers to these questions, do we think we would be able to use that knowledge to build a portfolio that has stronger staying power than what we’ve built now? Once you start to get past the idea that if you had tomorrow’s news, we’d be a step ahead, you start to realize we can only focus on the market that’s in front of us. So let’s dig in a bit more on some charts (my favorite).

- Our largest single individual holding across our entire client base just so happens to be the best-performing major fixed-income asset class in the world: T-Bills.

As long as the market is going to give us a 5.5% annualized return with virtually no risk, it’s going to remain a healthy portion of diversified portfolios. An upside down world has given us the opportunity to have one of the safest and also one of the best returns from the same investment. That doesn’t happen very often. And won’t last forever.

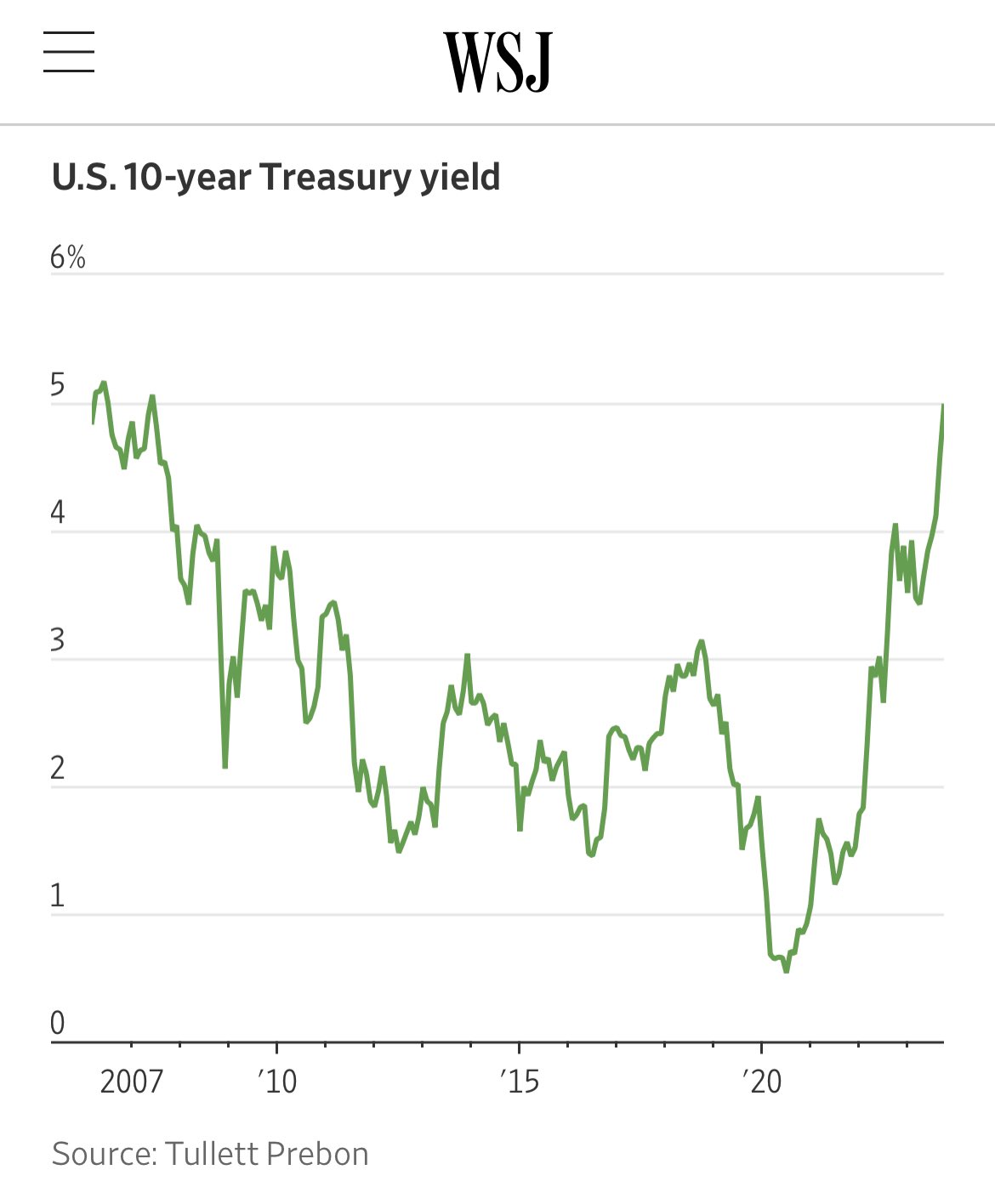

- The 10-year Treasury Yield is above 5% for the first time in 16 years.

Past Performance is not indicative of future results.

“The bond market shows that we have exited what once was considered ‘the new normal’ and considering economic forces that could keep yields high for years: global warming, the transition to green energy, deglobalization, demographic shifts and, of course, the ever-growing supply of government bonds – the free money experiment is over.” – Bank of America (h/t to Kyla Scanlon and her presentation at MIT).

“The surge in yields is the ideal excuse to crystallize fears over everything: the durability of the economic expansion, equity valuations, the size of federal deficits, the health of banks and whatever else gets the butterflies fluttering in the gut.” – Michael Santoli, CNBC senior market commentator (and one of the few you should be listening to on financial TV).

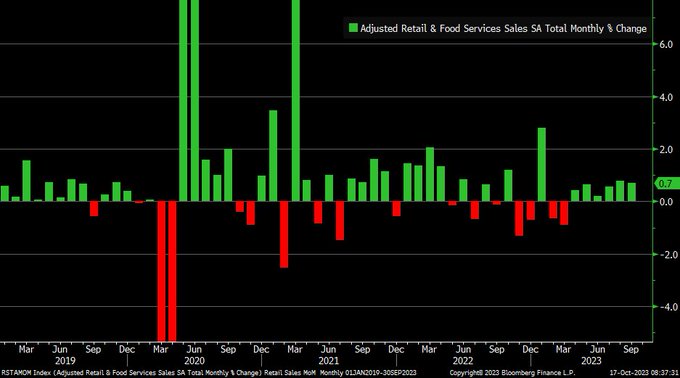

- Are we going into a recession? Not as long as people continue to spend like this.

According to Liz Ann Sonders, chief investment strategist at Charles Schwab, retail sales have been up for six consecutive months…a streak not seen since early-mid 2019. Consumer stays strong…for now.

Yet certain parts of the stock market is already priced like we’re in a recession. Small caps are trading at the same relative valuation as they were during the depths of the global financial crisis in 2008. We continue to look to build larger positions in small caps over the coming months, but so far, we’ve been early (read: we’ve been wrong).

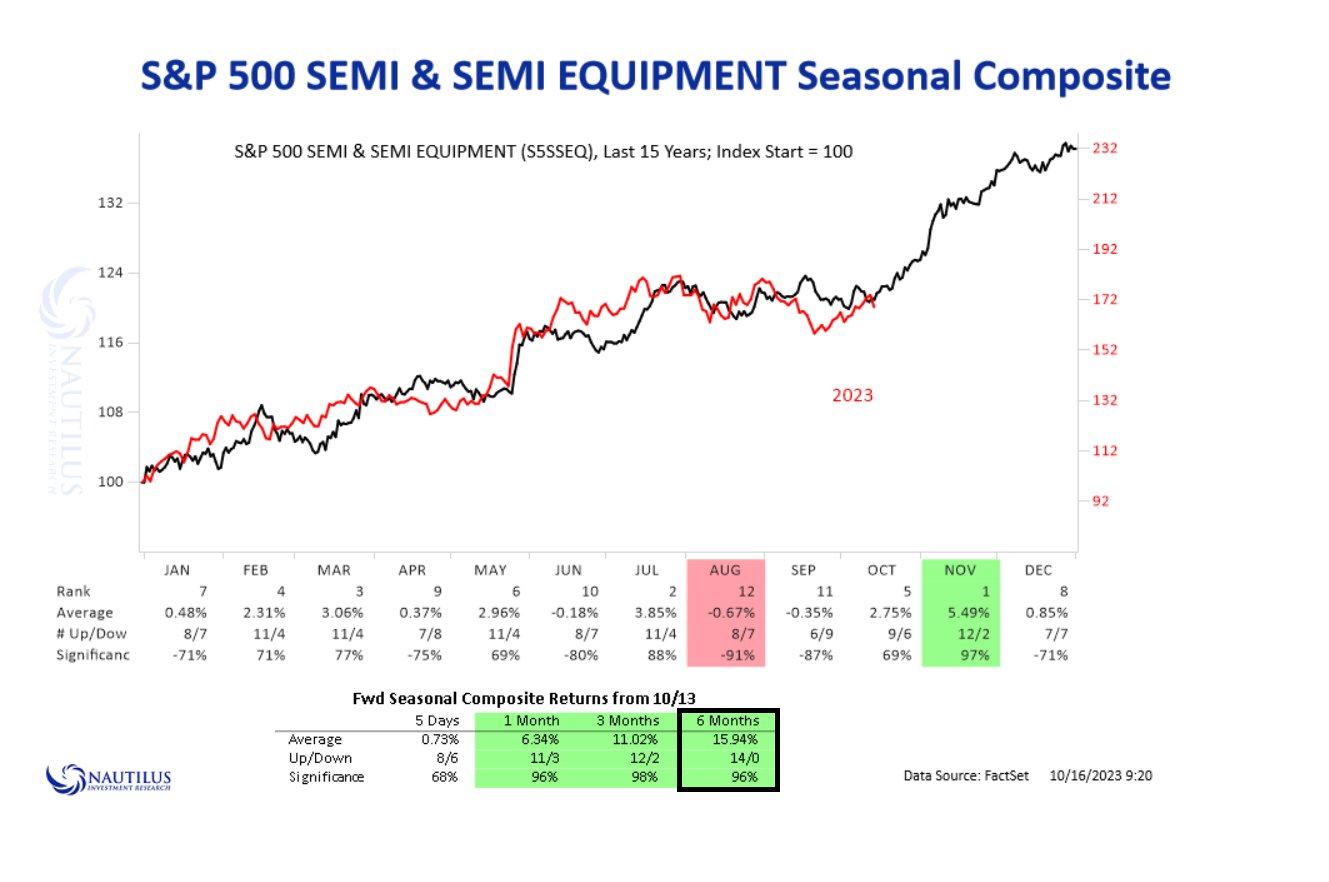

- What’s working in the stock market today? Semiconductors (AI) and energy.

The chart above from Nautilus Research, shows that over the last 14 years, the semiconductor index was higher all 14 times from the months of November to May.

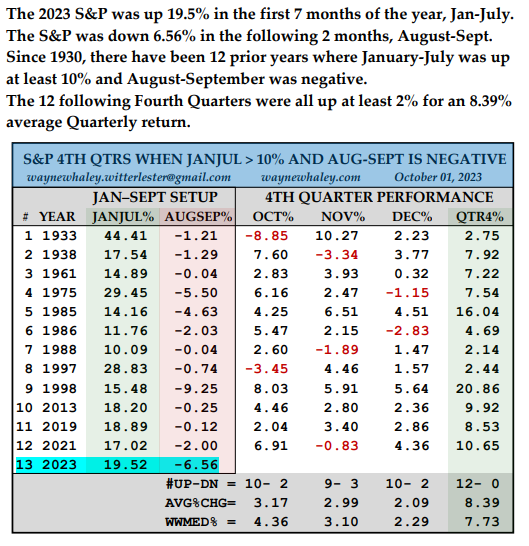

- Are there any historical periods that mimic the period we’re in now?

In the last 100 years (by the way, interest rates went up and down through these periods, too), when the first half of the year was very strong (up more than 10%) and we had a summer lull (Aug and Sep were lower), the fourth quarter of the year was up 12 times out of the last 12.

- Yeah, but energy is only up because of the war in the Middle East. Well…

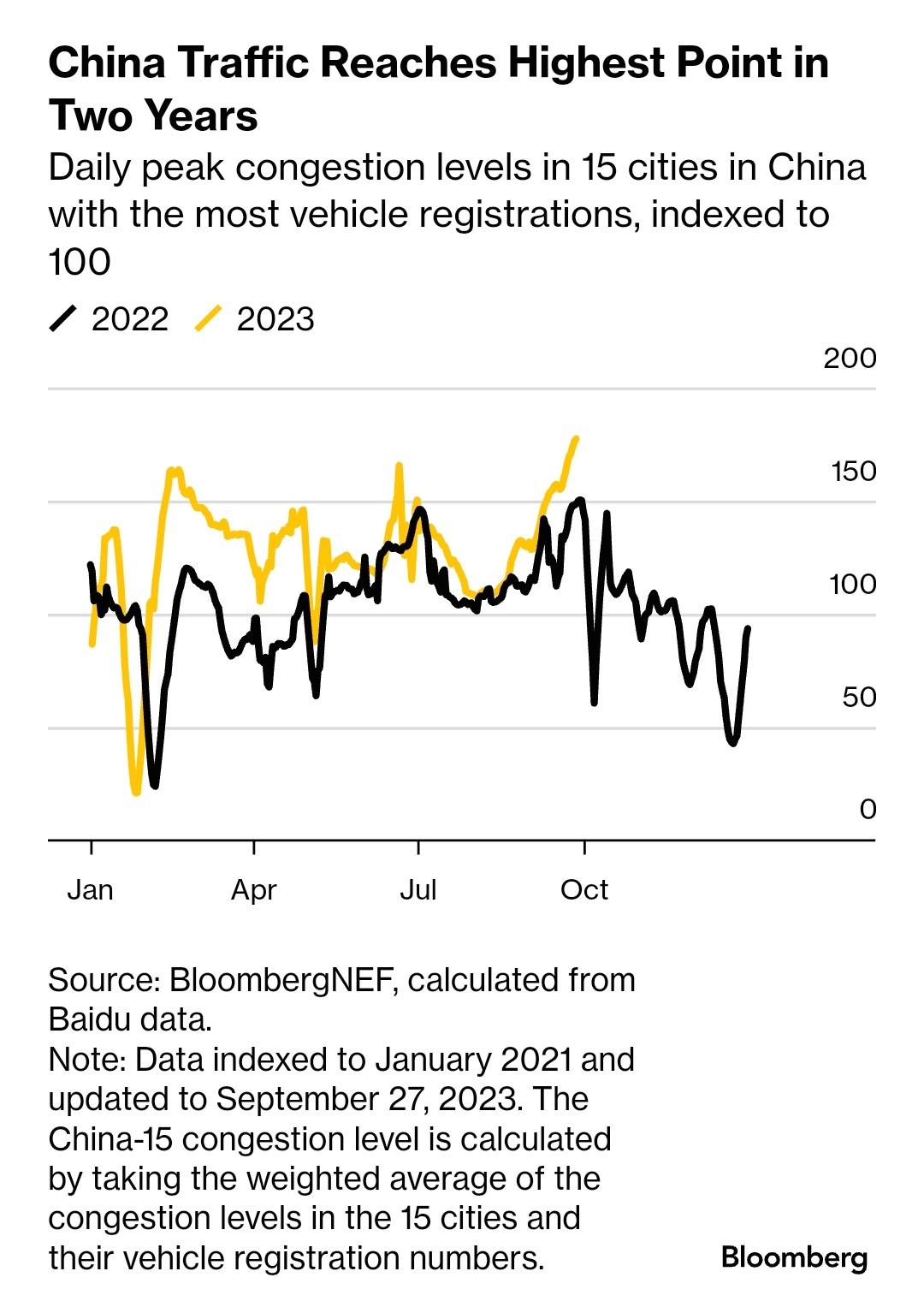

Perhaps the largest population center on the planet may be coming back in a bigger way than anyone is talking about right now. Something to watch.

We have no idea “why” these things happen. All we know is that they DID happen. Once we start refocusing our attention on what we know vs. what we think vs. what we can prove, only then can we start to match our short-term stock market thesis with each person’s individual goals.

May we live in interesting times,

Adam