“But I come from out there, and everybody out there knows, everybody lies: cops lie, newspapers lie, parents lie. The one thing you can count on – word on the street… yeah, that’s solid.” – Christopher Walken, Suicide Kings

For this month’s blog, I thought I would give you a glimpse into the conversations we’ve been having with clients lately.

-

- “It feels like my account really hasn’t gone much of anywhere.”

That’s because it’s true. To be honest, the average stock hasn’t gone much anywhere. The equal-weighted S&P 500 is trading at the exact same price as March of 2021. Year-to-date, it’s up 1%.

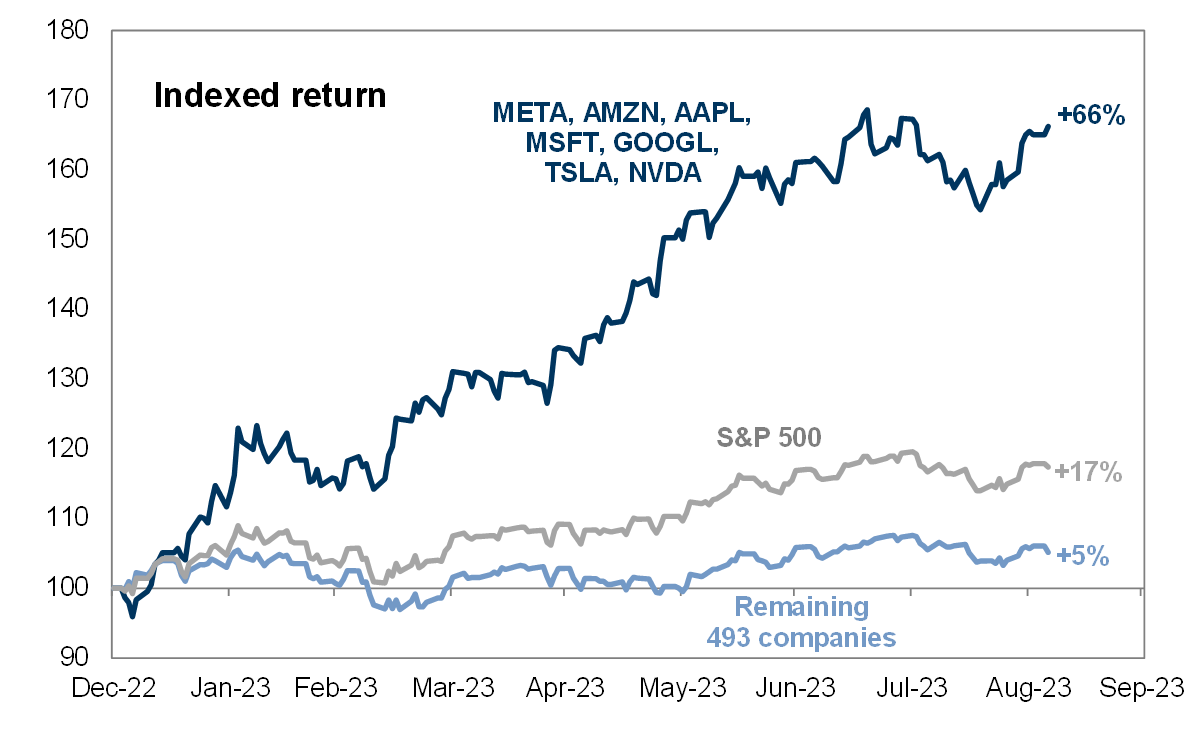

“But, Adam, the actual S&P 500 is up more than 11% this year.”

Thanks to the Magnificent Seven.

Diversification means always having to say you’re sorry.

2. “Should I be worried about another government shutdown?”

Sure. I worry about a myriad of potential risks to client portfolios each day. Most of them don’t make to the level of “actionable”, but I’m always happy to go down the rabbit hole. Let’s take a look at how the S&P 500 has done in previous government shutdowns (which happens on average about every 2.5 years).

Looks to me like the average return during shutdowns is slightly positive, and looking 12 months out, it’s about 12% higher (again, on average).

The reason we pay attention to the stock market on a day-to-day basis isn’t to inundate ourselves with the noise of short-term price fluctuations, but rather to glean additional insights about the human condition and how crowds react. In short, we love learning.

3. “Is there any better opportunities out there than 5.5% Treasury Bills?”

Of course. In hindsight they will be easy to see (and easy to convince yourself that you could have seen them). But chasing the flavor of the quarter is not sustainable.

Said brilliantly recently by Sam Ro of TKer, “If only 20% of large-cap equity fund managers beat the S&P 500 over the past three years, then being in an S&P 500 index fund means you would’ve beaten 80% of the professional money managers during the period.” This reminds me of the story where a 6-foot tall man drowned in a lake that was on average, 4-feet deep.

We have more than enough potential headwinds on the horizon (interest rates, degloballization, government dysfunction, striking union workers, etc.). Try not to make this harder than it needs to be. Sometimes, boring is sexy.

– Adam