Our September 24th post entitled, When It Comes Time to Buy, You Won’t Want To“, we viewed the small dip that was occurring as a healthy pullback as well as detailed a couple reasons why it was a good buying opportunity (even going as far as mentioning 3600 as a possible year-end price for the S&P 500).

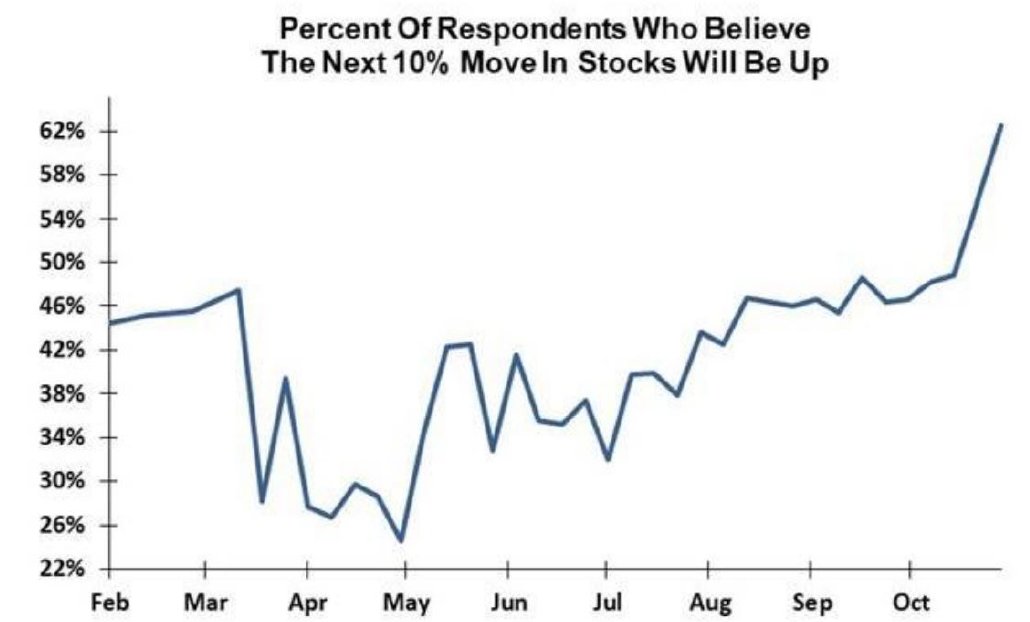

As we sit today, since 9/24, the Dow Jones and the S&P 500 are both up almost 12%, while the sentiment in the marketplace has completely flipped since prior to the general election. Obviously with the prospects of highly effective vaccines coming in Q1 or Q2 of 2021, as well as the most accommodating financial conditions of the past decade, there is great reason for optimism. Per Evercore ISI, in a survey of 303 institutional investors, 63% now believe the next 10% move in stocks will be up.

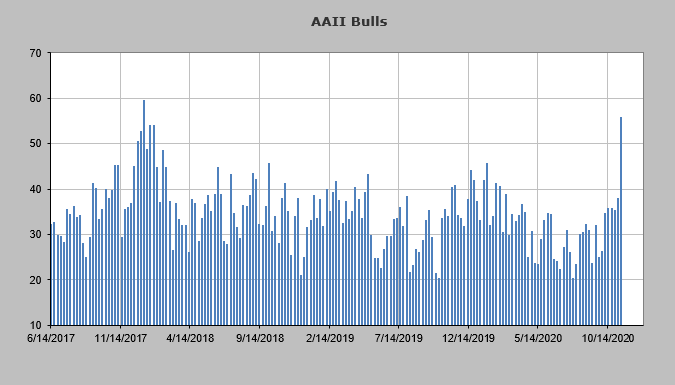

According to the AAII Sentiment Survey in mid-November, bulls had reached the highest percentage since January of 2018 (56%)

An oft quoted measure from previous blog posts is the CNN Fear and Greed index. The index was 25 just before the election. Today it’s 91.

When conditions look as though the stock market can only go in one direction, we start to get this feeling like things aren’t “too hot or too cold”. This gives rise to the “Goldilocks” moniker. From a financial standpoint, the base case appears to be

- A Biden Presidency

- A Republican Senate (Divided Congress)

- No Massive Spending to Spook the Bond Markets

- No Major Tax Hikes

- A Ton of Liquidity and Near Zero Interest Rates from the Fed

- Effective Vaccines

- Return to Normalcy for Government

We are here to bring you back to earth. We don’t think the next great depression is starting, but to ignore the sentiment froth in the marketplace right now would be a mistake. If you’re looking to devote additional capital we would be very skeptical at this point. If you’re thinking of additional capital needs over the next several months, we feel now would be a decent time to take advantage of the recent run-up, until fear starts to come back into the market.

As always, if you are curious about how this information affects your individual situation, please give us a call.

Be safe, be thankful, and be well,

Adam