Hi all,

As first alluded to in our post from April of this year, patience remains paramount. The massive accommodation to the economy from years of ZIRP (zero-interest rate policy) combined with the unprecedented fiscal stimulus during the pandemic created the “helicopter money” scenario made famous by Ben Bernanke during the great financial crisis of 2008. For the better part of the last 15 years, we heard that gloom, boom, and doom, were headed for the United States as we would eventually have to face the music for leaving monetary policy so lax and for ignoring the past lessons of hyper-inflation from the Wiemar Republic and countless other examples throughout world history.

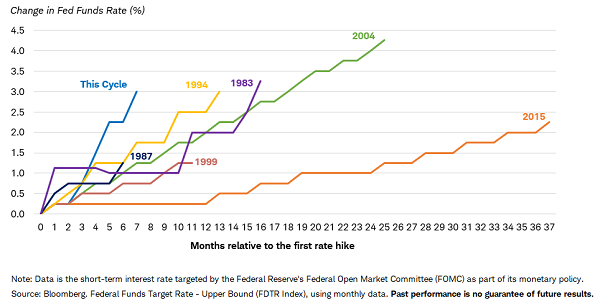

This year, we have begun to pay the piper. The effective Federal Funds Rate, the rate at which banks borrow from the Federal Reserve (and which affects all other consumer rates), is now 3% after the Fed meeting last week. The purpose of this is to combat inflation as well as mop up the excess liquidity in the system and get back to a monetary policy in which the Federal Reserve is neither helping (accommodative) nor hurting (restrictive). The pace and magnitude of these Federal Reserve moves, at least for the last 50 years, has been the fastest on record.

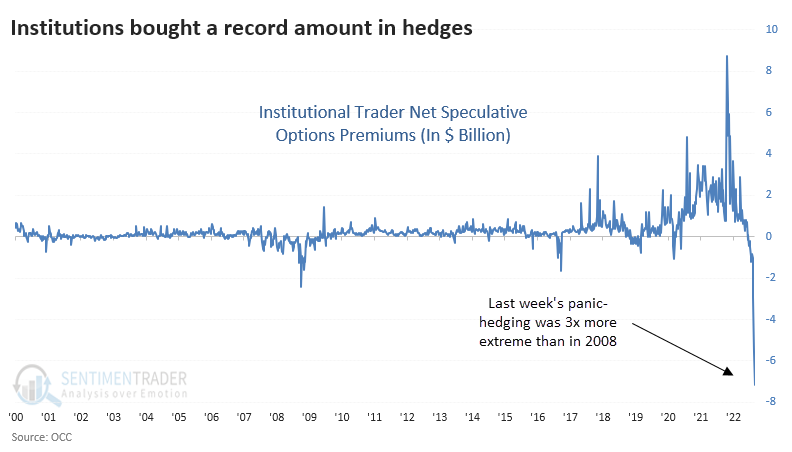

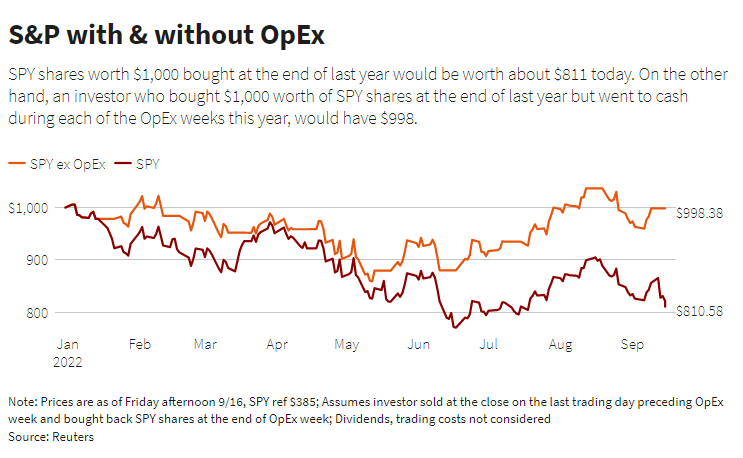

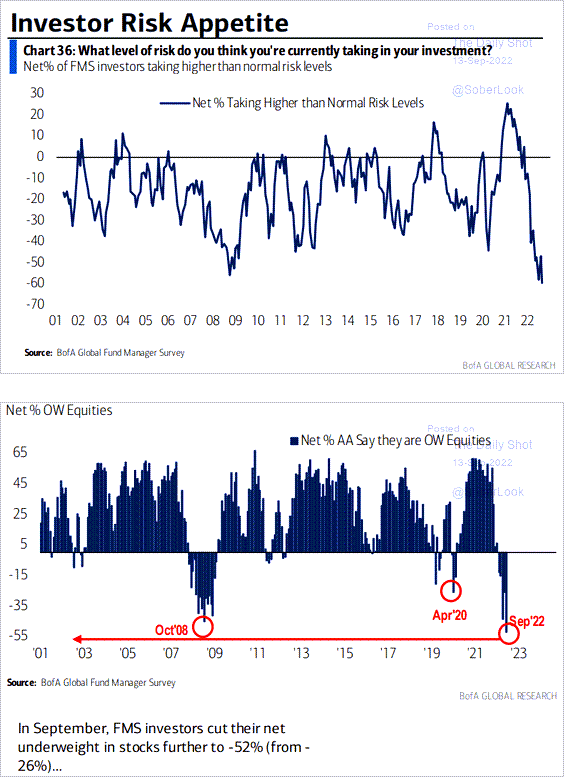

From the beginning of this year, we have seen a systematic flow of funds out of highly speculative assets such as cryptocurrencies, non-profitable tech stocks, pandemic darlings, and “meme” stocks, to name a few. We believe the next excess to be eliminated will be quick stock market returns. There is a collection of individuals in the stock market still looking to cut corners. We believe in order for the stock market to gain solid footing and start to be priced based on fundamentals, we will need to see the weekly option volumes collapse, and the gamble (YOLO) mentality to fade. In recent weeks, betting against the economy (and the stock market) has gained as much fervor in the opposite direction as we saw during the post-pandemic euphoria. Here’s a couple charts to show how historically negative people have become.

To show the point a bit differently, if you were to eliminate each week of the month where options expire (typically the third Saturday of each month), the S&P 500 is almost unchanged for the year.

Investors have even gone so far as to sell a greater percentage of equities during the past few months than they did at the depths of the great financial crisis.

What does all this mean? For younger investors, or those of us who are still adding to our long-term portfolios, it’s actually good news. If you make the assumption that the world isn’t going into the next great depression, these purchases at lower prices will end up being some of the most difficult ones to make, while at the same time, being some of the most profitable of your financial journey. For those of you approaching retirement, we made a substantive change near the beginning of August, rotating out of bond funds, into shorter duration treasuries to ensure that the stable portion of your portfolio acts as a buffer. And finally for those people taking income from their portfolios, it’s an opportunity to trade up in quality once again (just like in March 2020) to ensure stable dividend yields to help fund retirement expenses.

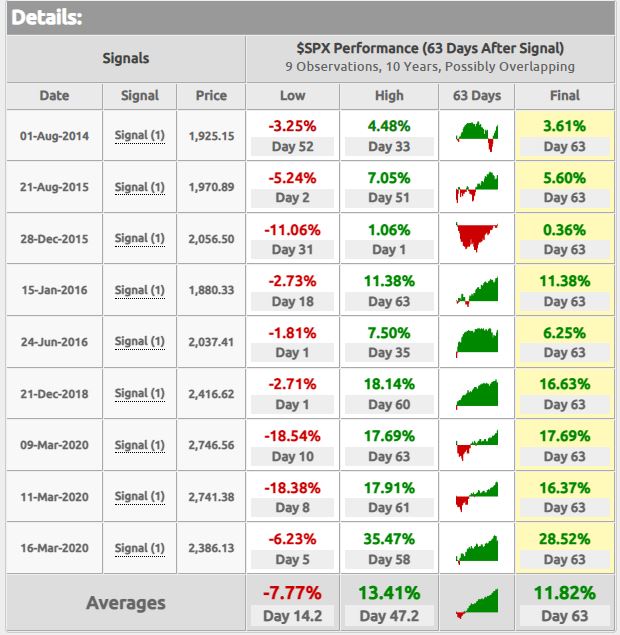

And just because I choose to be a bit of a glass half full type of advisor (this is more profitable over the long-run, trust me), there is a morsel of good data that we may be reaching a bit of an inflection point and a bear market rally may be in the cards, albeit after the early part of October. In the past 10 years, when the amount of downside protection for individual stocks has outpaced upside bets on any given day, the average return over the next two months is 11.82% (but the bad part is that over the next two weeks, the average downside is -7%).

Hold your nose a bit longer and we believe your patience and resolve will be rewarded.

– Adam