As you may have heard, COVID cases, hospitalizations, and deaths are likely to reach pandemic lows over the weekend. Recently, over 50% of the US population crossed the vaccination threshold and the optimism over a reopening economy is palpable. In recent months, investment professionals throughout the country have rebalanced portfolios away from technology stocks toward these reopen names in the hopes of a “catch-up” trade, but our belief going into to summer would be to fade the move. Howard Marks says this most simply, “Non-consensus views can make money for you, but to do so, they must be right.” Something we do here at Second Level Capital, is to first help identify consensus. This is difficult in it’s own right, but it’s where behavioral and sentiment analysis comes in quite handy. Here’s a few examples over the last month.

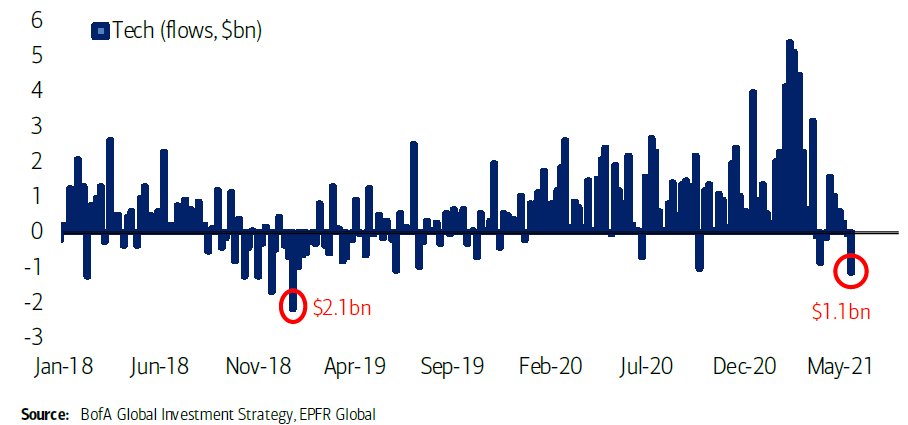

According to Bank of America, two weeks ago showed the largest outflow from the tech sector since December of 2018.

Also from Bank of America, the technology allocation for investment professionals is now at the lowest point since the beginning of the global financial crisis in 2007.

Couldn’t get great quality on this one, but this one happens to be from Morgan Stanley which shows the divergence between the best performers of the market and the worst performers (emerging growth technology stocks, which were the darlings of 2020).

While we feel the reopen trade will continue and overall economic activity will reach levels not seen in many years, valuation is starting to become a concern for the reopen stocks and we believe a shift back TOWARD technology, specifically large cap technology, should be where new capital should be placed.

Overall, we expect more sideways action as the summer trading volume lull comes into focus.

For one more fun spurious correlation and a keen reminder that we do not have a crystal ball, is it possible that Phil Mickelson has done the market a favor by becoming the older ever Major golf tournament winner?

Have a great holiday weekend everyone!

Talk to you again next month,

Adam