As we enter the “Santa Claus Rally” phase during the final five trading days of the year (as well as the first two of the following year), let’s look back on the trends of 2022, and think about what may come in 2023.

As you can see from the chart below, courtesy of Liz Ann Sonders, chief investment strategist at Charles Schwab, there have been very few places to hide. After more than a decade of growth stocks trouncing value names, the unloved equities ended up with the last laugh, although December has been a month to forget among months to forget this year.

The S&P 500 is on pace for the 4th worst year since the modern inception of the index in 1957. Back-to-back down years have only happened during four distinct periods: The Great Depression, WWII, Stagflation of 1973-1974, and the Dot Com Bust. Maybe we’re in one of these periods, it’s certainly possible, but not my base case.

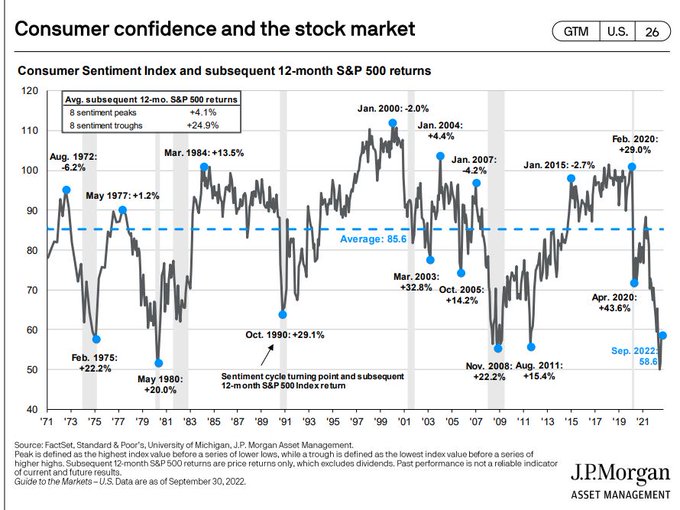

Bears have outnumbered Bulls in the AAII sentiment poll for 39 consecutive weeks (since April 7). That’s the longest streak since they started tracking the data in 1987. The University of Michigan’s Consumer Sentiment Index has been below 60 for 8 consecutive months, the longest streak since they started collecting data in 1952.

Why do I even care that everyone is so bearish? Why do I even follow these statistics? Because, in general, the markets vacillate between “the sky is falling” and “irrational exuberance” (guess which one is it right now). But in the real world, things usually stay somewhere between “pretty good” or “not so great”. The chart below shows what happens when the market decides (some day) the sky ISN’T falling, and realizes, once again, this too shall pass.

This past week, Guggenheim’s chief investment officer, Scott Minerd, had a massive heart attack during his routine morning workout and died at the age of 63. Late last year, Citi’s beloved strategist, Tobias Levkovich, was struck by car and passed away at the age of 60. The last three years have brought more death and sickness than most of us have experienced in our lifetimes. During this holiday season, while we preach to have a longer-term outlook on your financial life, please remember how relatively short our time here can be.

We will be sending out our 2023 outlook early in the new year, so be on the lookout, but until then…

Happy Holidays and Merry New Year to all!

– Adam