After a January that saw the S&P 500 decline by more than 5%, February is nearing a close with similar results. At this point, it would be very natural for the “snowball effect” to start occurring in your minds.

As always, taking a measured approach, rather than emotional one will continue to be our advice. That being said, let’s take a look at several different possibilities moving forward.

-

- A New Normal

With the market now expecting 5+ rate hikes in 2022 (effectively doubling the 10-year Treasury yield from last year), are we now in an environment where it’s impossible for stocks to go up? Well, looking back at the market since 1950, that hasn’t quite been the case (tip of the cap to Ben Carlson from Ritholtz Wealth Management for doing the heavy lifting here).

2. The Perfect Storm

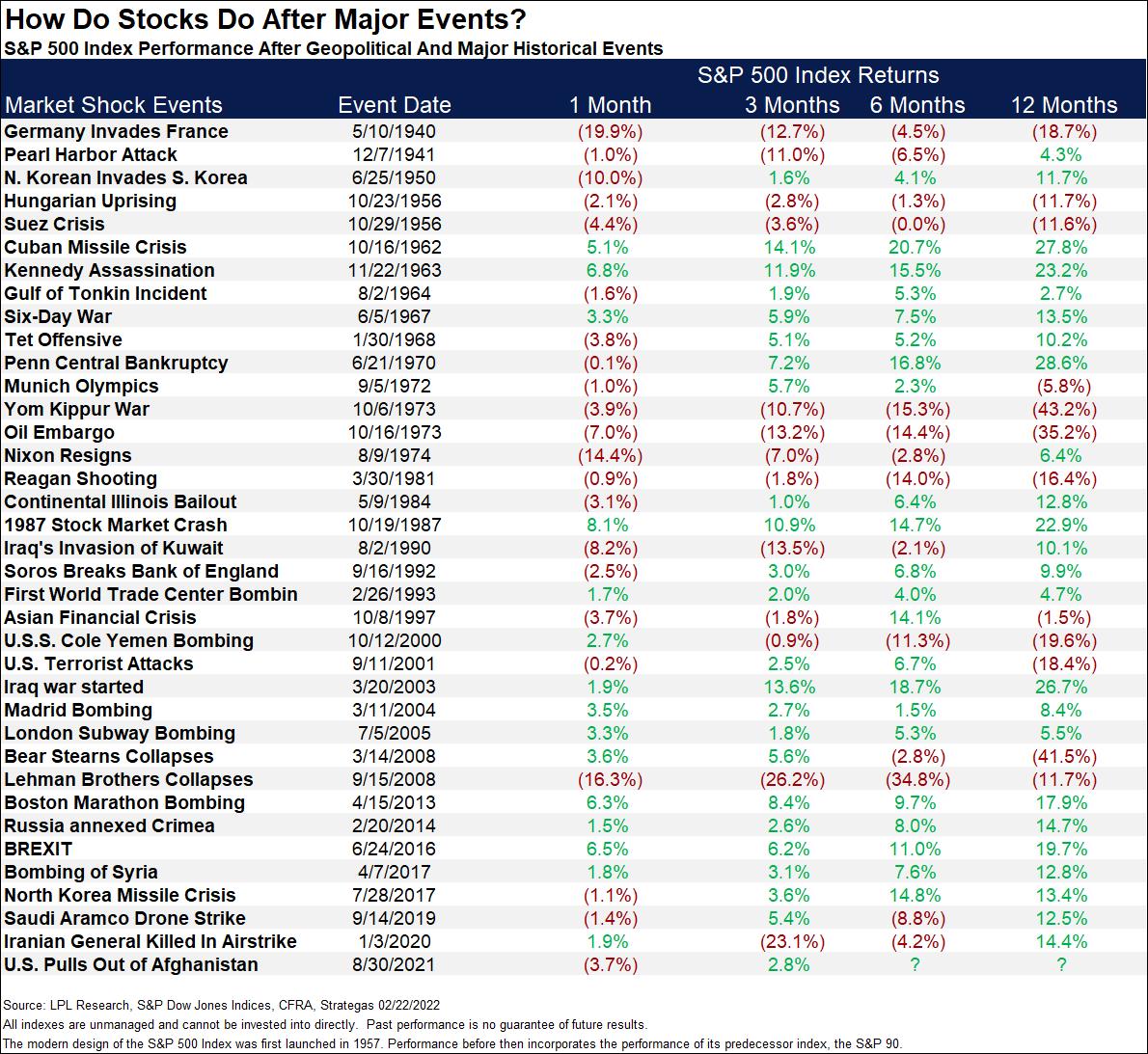

Adding to the Federal Reserve’s tough talk about raising interest rates to tamp down inflation is the geopolitical environment. Below is the list of every major geopolitical event of the last 75 years and how stocks fared during the event itself and then how long it took to recover. Seems like a lot of green for something that feels like the end of the world, doesn’t it?

3. Same as it Ever Was?

Our contention at Second Level Capital is that everything that’s happened this year as it relates to the indexes has been pretty normal. Here’s a list of stock market returns since 1928 and how far the S&P 500 fell from it’s – high.

The only real problem we see is that the two LEAST volatile years in the last 25, have been 2017 and 2021. Said another way…you guys are spoiled. The average drawdown over this 94 year period is -16.5% (the S&P 500 was down 12% this year, which lasted for about three hours on January 24th).

Paraphasing CNBC’s Michael Santoli, the million dollar question is if the ability for the S&P 500 to hold this current level (down about 10%) with 5+ rate hikes on the horizon, oil nearing $100 per barrel, and large tech firms like Facebook losing hundreds of billion dollars in market cap is an impressive show of resilience, or a delusional delay of the inevitable. The answer will come in time, but our bias remains the former.

– Adam