As we sit here in late April, over the past week we have seen new all-time highs for the S&P 500, the Nasdaq, the Dow Jones Industrial Average, the Dow Jones Transportation Index, the Healthcare sector, the Consumer Discretionary sector….well, you get the idea. Did you know that the S&P 500 has closed higher 14 of the last 15 years during the month of April for almost a 3% average gain? (a thank you to Steve Deppe for this one). While April showers bring May flowers, it appears they also bring some decent stock market gains.

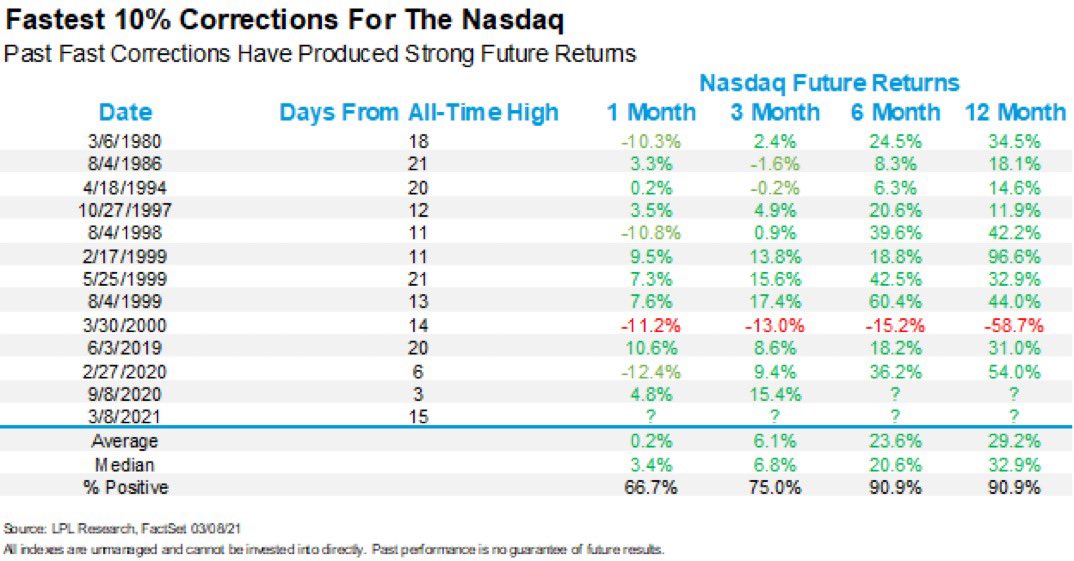

While the speed and magnitude of the sharp 10-year interest rate rise this year (from .91% to a high of 1.77%, now around 1.55%) had investors trading their fast growth and big technology names for more inflation-protected assets, we felt it was a dip worth buying. We have continued to recommend large-cap technology throughout our portfolios, but not because we’re perma-bulls, but because history provides us context for a longer-term edge. According to LPL Research, when coming from an all-time high price and dropping 10%, over 90% of the forward returns have been positive within 6 months (averaging 23% over that period too).

Furthering our confidence that it was a buyable dip was the fact that Nasdaq was in a seasonally weak period and tends to make its bottom in March.

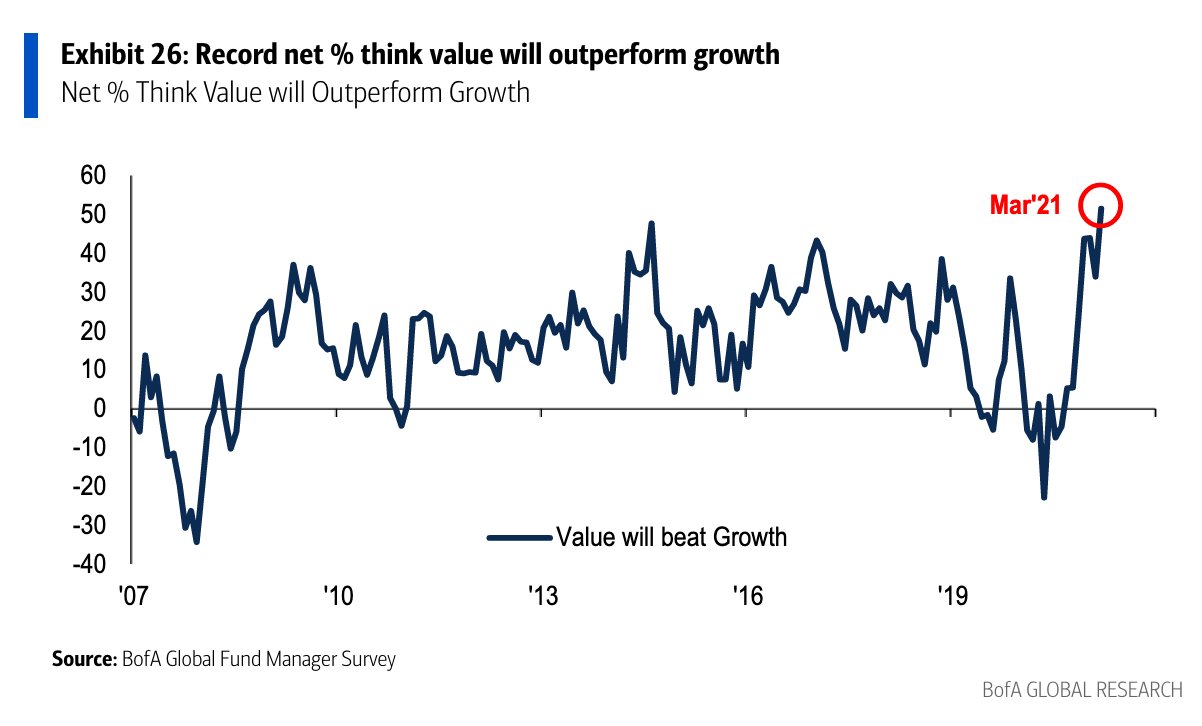

Paraphrasing Michael Santoli, he said, “The choppiness of the past few months had been a fitful realignment of asset prices to account for a reflationary acceleration and profit recovery. But along the way the “reopen trade” gets crowded and no longer cheap, while quality grows less loved and less expensive.” Combined with the fact that the greatest percentage of global fund managers in the past 15 years believe that value will outperform growth, we simply felt that technology was a little unloved.

But as I mentioned at the beginning of the post, we’re back at all-time highs, almost across the board (the Russell 2000 small caps have lagged a big as the “reopening” stocks have taken a little breather. So what now? With over 95% of the S&P 500 stocks above their 200-day moving average, it doesn’t get much better than this. Which is to say, that if you are devoting NEW capital to the markets, it’s probably time to wait for a better entry point, but our view that 2021 will be a positive one for overall equities is very much intact. We are still watching our main possible pitfalls very closely (Inflation, Interest Rates, and COVID), but as the Federal Reserve had clearly indicated, it doesn’t see interest rates rising until well into 2022, and until then, market traders will likely continue to front-run any potential tapering of QE (which will be seen a precursor to an interest rate rise) as a sign of a top. We are happy to let people continue to try and time the market and call a top, while we wait for actual information and then react as best we can.

Thank you all for reading, and look forward again to talking next month.

– Adam