Hi all,

After a horrible start to 2022, the S&P 500 managed to rally 11.4% from March 14th to March 29th. Just enough to save a little anxiety when people opened their 401K statements in early April. Since then, we’ve retraced most of that move, but have oscillated between 4200 and 4500 on the S&P for the last few weeks. Every bit of optimistic news seems to be immediately met with additional Federal Reserve hawkishness (raising rates faster to combat inflation) or disappointing economic news.

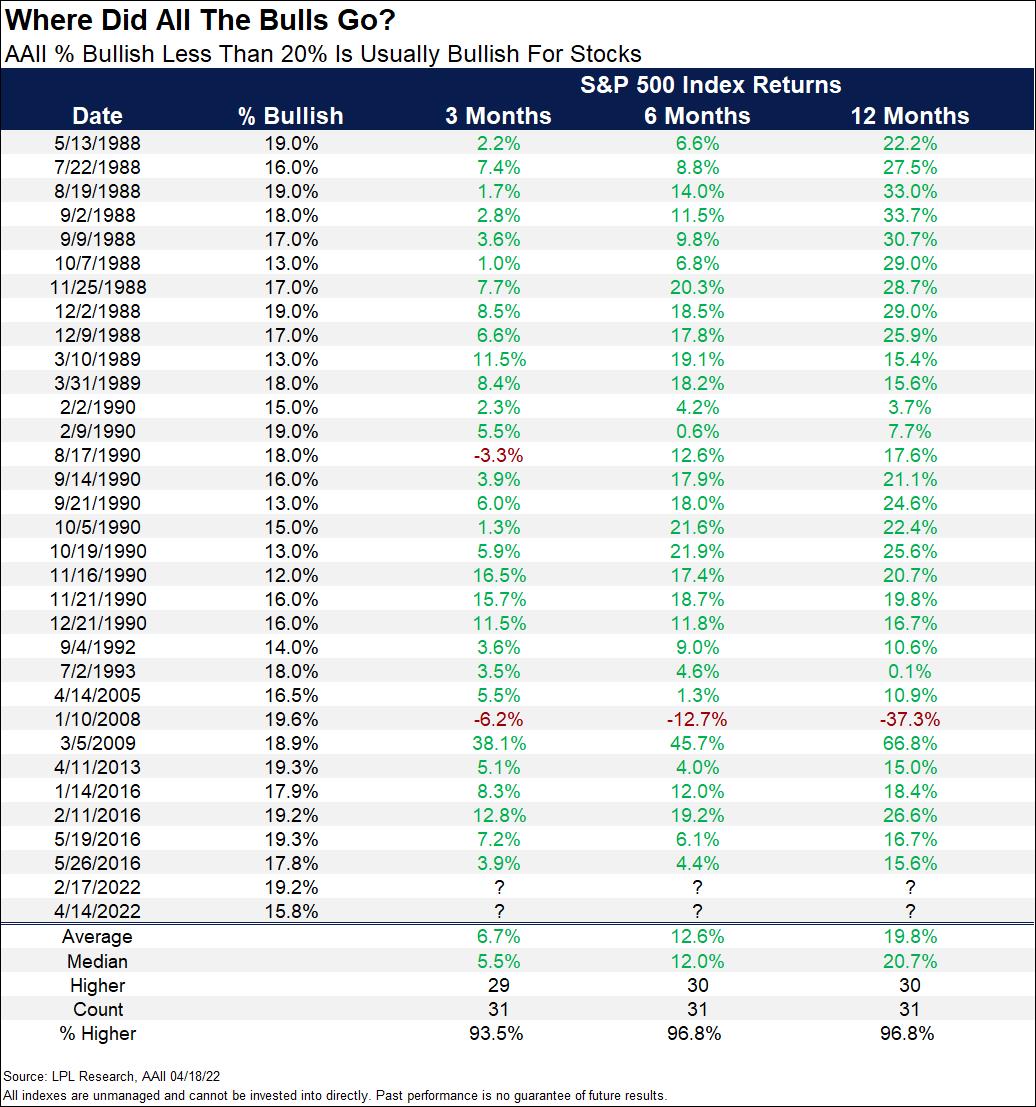

We view the rally in mid March as more of a technical one. Meaning simply, that too many people became too bearish, too fast, and an inevitable snap back was on the horizon. Flash forward to now, sentiment again has reached massively negative levels, and in fact, we have some of the most negative readings since the early 1990s, even lower than during the global financial crisis (see below, courtesy of Bespoke).

The good news about the negativity permeating the markets is that when the AAII bullish percentage goes below 20%, it usually doesn’t stay there for long, and three months later, there is a 93% winning percentage over the last 35 years, with the one outlier in 2008.

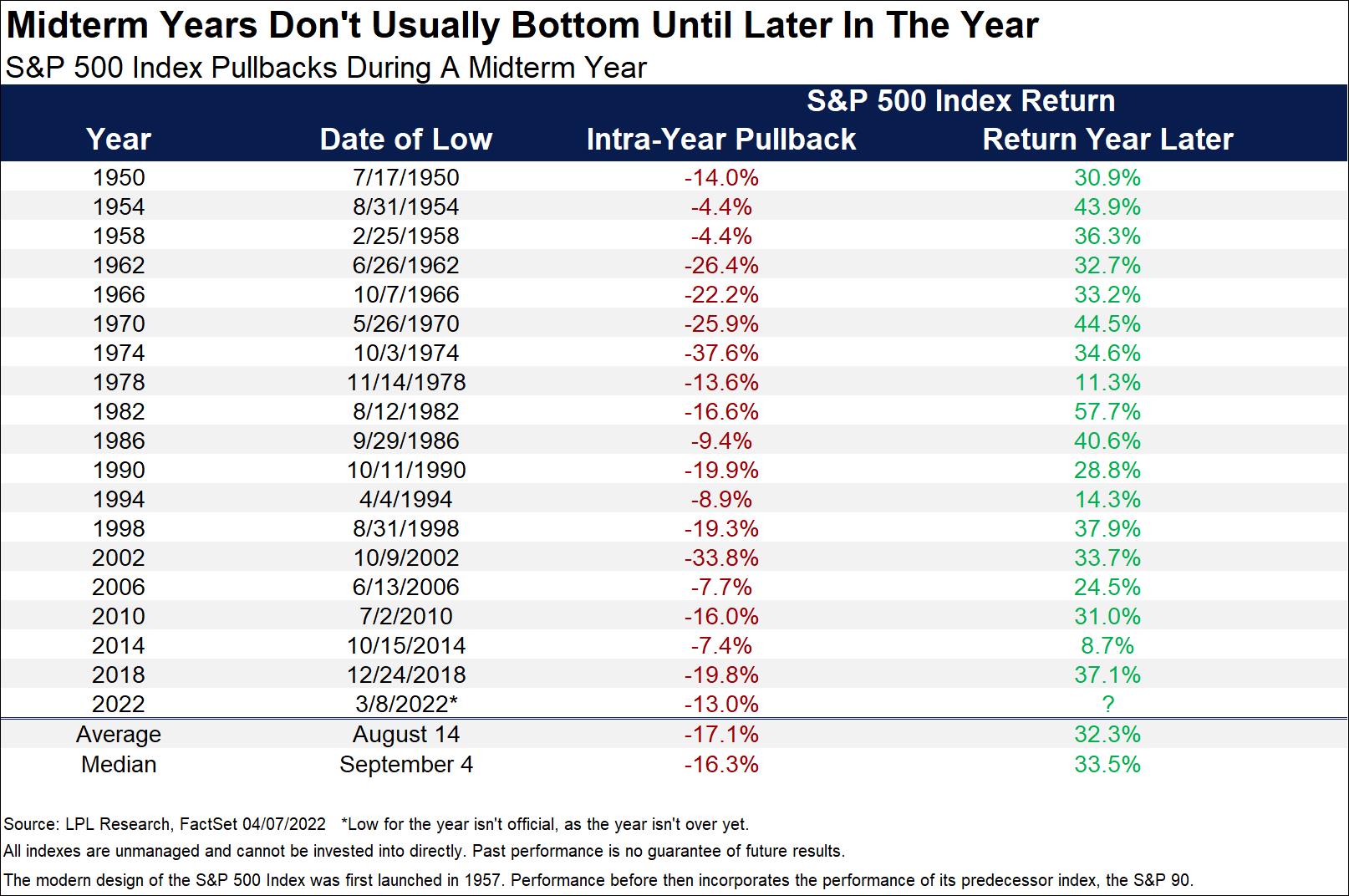

So the possibility for another sharp advance could be in the cards, but our current view is that more frustration is ahead. Wanting to get back to the high watermark in your investment accounts will not make it so. As we have said in previous posts, patience is paramount. Below is a another chart from Ryan Detrick of LPL, showing that especially in midterm election years, the markets don’t usually bottom until later in the year, with the average being around August 14th. The good news here is that 12 months later, we have been positive 100% of the time since 1950, with an average (from that bottom) of 32%.

The early read from corporate earnings is that they are holding up quite well, but we continue to believe that something will need to break in the favor of the bulls on the fundamental side for the advance to really catch its footing. The urge here feels like we need to “do something”, move faster, or make up for lost time. In our experience this is precisely what gets people in trouble and that’s what we will likely continue to internally fight over the next few months.

What we’re watching right now is for any signs of inflation peaking (CPI/PPI reports cooling off a bit, energy and commodity pricing coming down), interest rate declines (the 10-year rate under 2.64% could signal a short-term trend change), or some type of resolution for the Russian/Ukraine situation (which is a much larger problem for Europe, but is still affecting American pocketbooks).

We hope that everyone had a nice holiday and after the next few weeks of earnings as well as the Federal Reserve rate decision in mid-May, we should have a little more clarity about where we are headed.

– Adam