Hi all,

As I sit at the computer right now, the equal weight S&P 500 (if you owned one share of each company) is currently down one quarter of one percent (-.25%). The market has continued to be inundated with Q4 earnings, election primaries, and geopolitical tensions. The market has responded with a resounding opinion: meh.

Let’s get a better idea of the push and pull playing out in the hearts and minds of the bulls and bears.

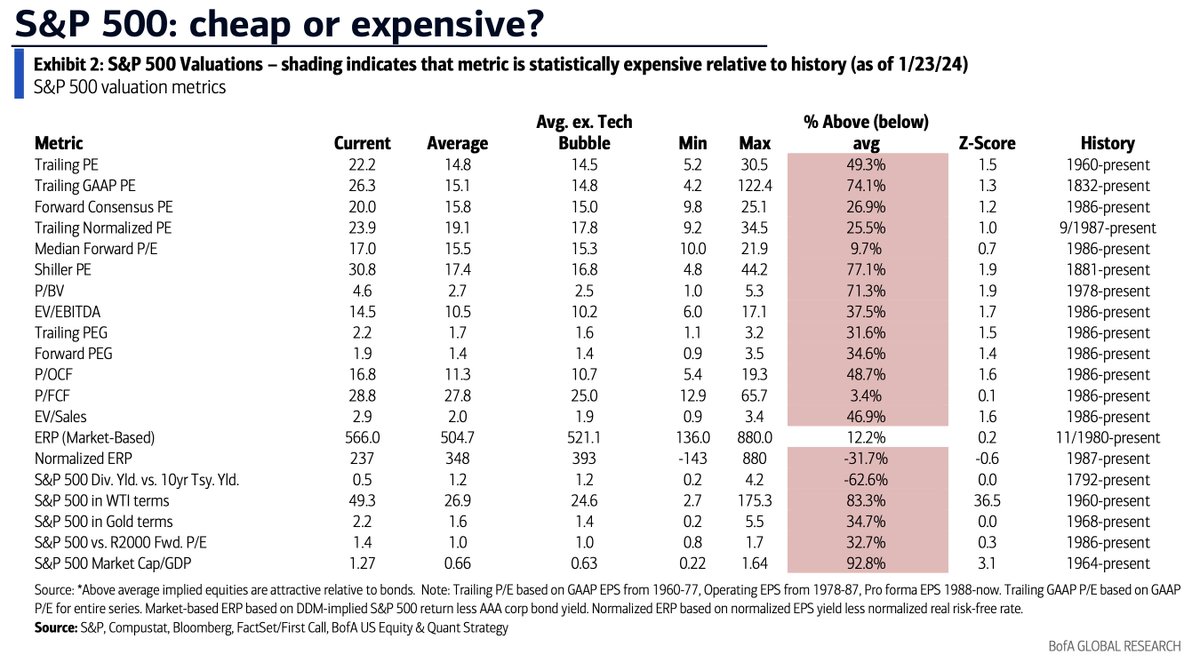

- The S&P 500 is statistically expensive. On almost every metric, we are above long-term averages. Whether or not the S&P gets cheaper or more expensive from here is truly anyone’s guess.

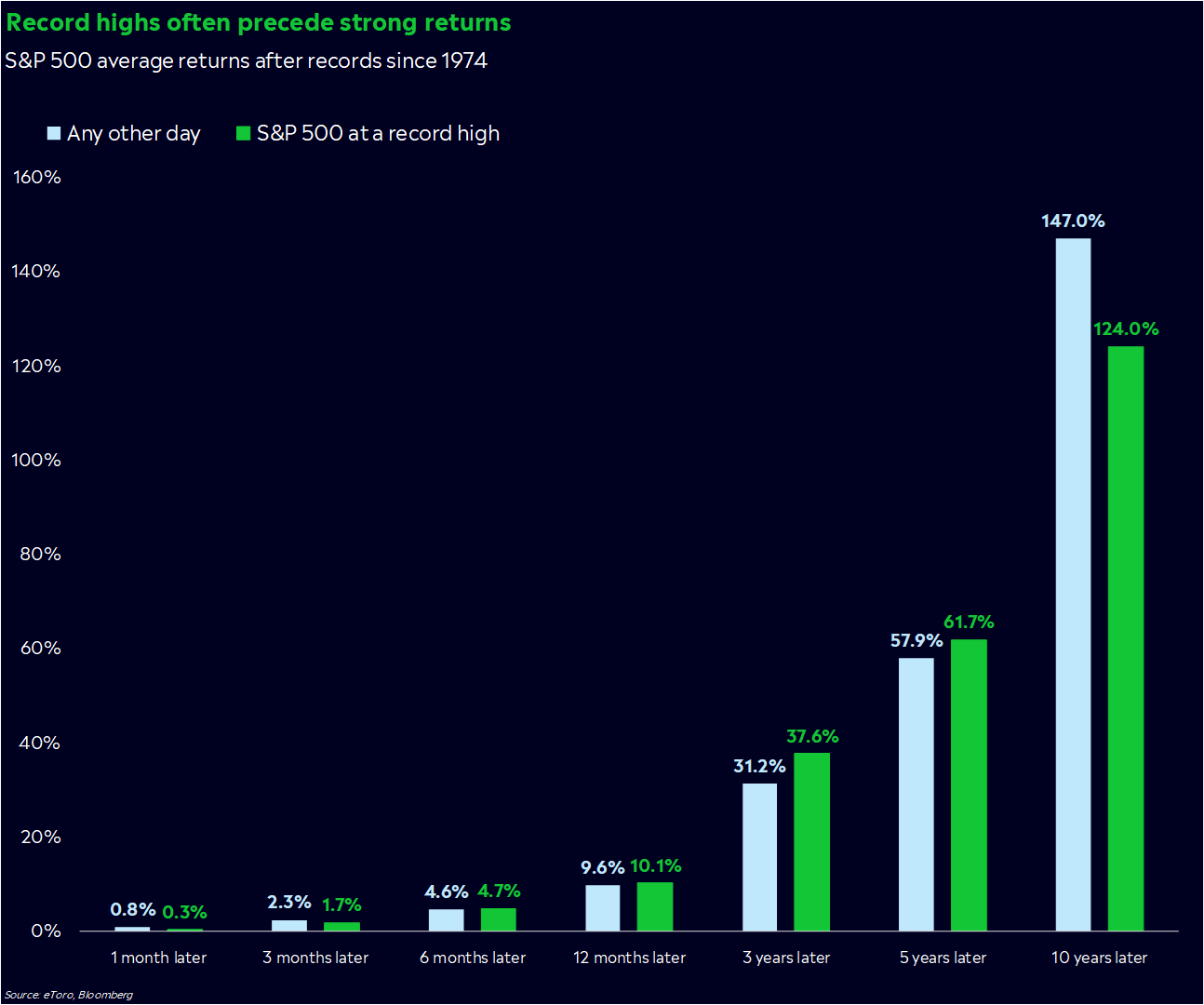

Past performance is not indicative of future results - The S&P 500 is at an all-time high. The chart below from Callie Cox at eToro attempts to dispel the myth of investing at all-time highs. Counter-intuitively, in the financial markets, strength begets strength.

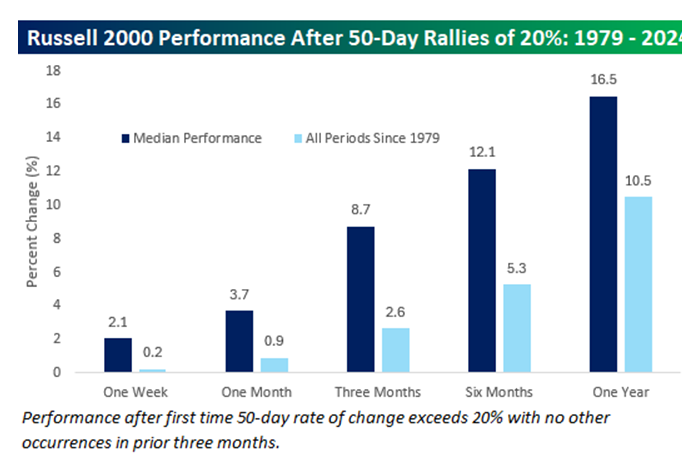

Past performance is not indicative of future results - Different than what we saw to end last year, leadership in the market has started to narrow (large-cap Tech and AI names have once again been the engine pushing the markets to all-time highs). But while narrow leadership is a certainly cause for pause, history tells us that when small caps (Russell 2000) start a year with a decline of at least 4%, the median performance for the remainder of the year was 26.1%, increasing 6 out of the 7 times since 1979. 20%+ rallies like we saw at the end of last year, tend to lead to further strength in the weeks and months ahead. Again, strength begets strength.

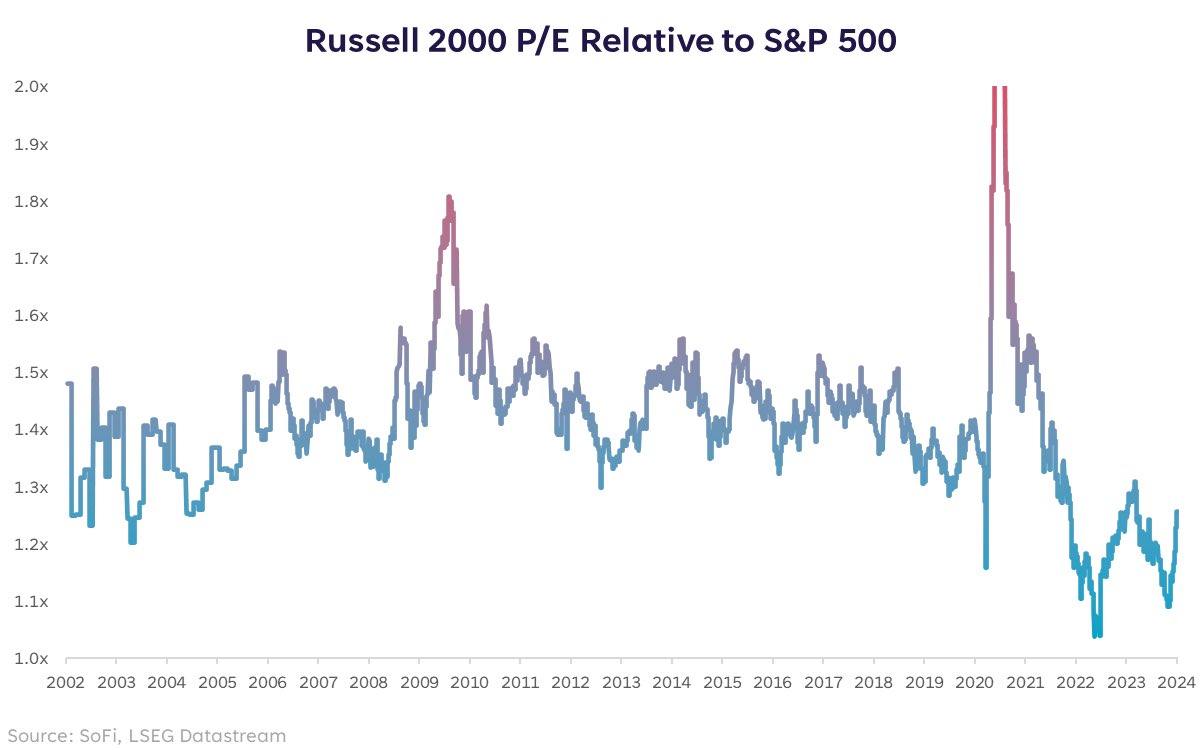

Source: Bespoke Investments. Past performance is not indicative of future results - We continue to recommend overweighting small caps (Russell 2000) and biotechnology for longer-term client portfolios. Small caps remain cheap relative to the S&P 500, and the pharmaceutical industry is coming up to a patent cliff over the next five years that is 2.5 times greater than the previous five years. We believe smaller companies with promise will likely start to get gobbled up by the larger firms looking to restock their pipelines.

Past performance is not indicative of future results Past performance is not indicative of future results

In short, this is about as strong of an economy that anyone could expect after the Federal Reserve raised rates substantially over the past two years, but for some reason we (including us) are paranoid about the next shoe to drop. There’s certainly a bit of froth that can be taken away from the stock market in the short-term (we’re counting on it), but perhaps we should start seeing the market for what it is: an overall reflection of things getting a bit better.

– Adam

I understood the information in this one. These posts are proving themselves to be useful education. Please keep sharing!