Hi all,

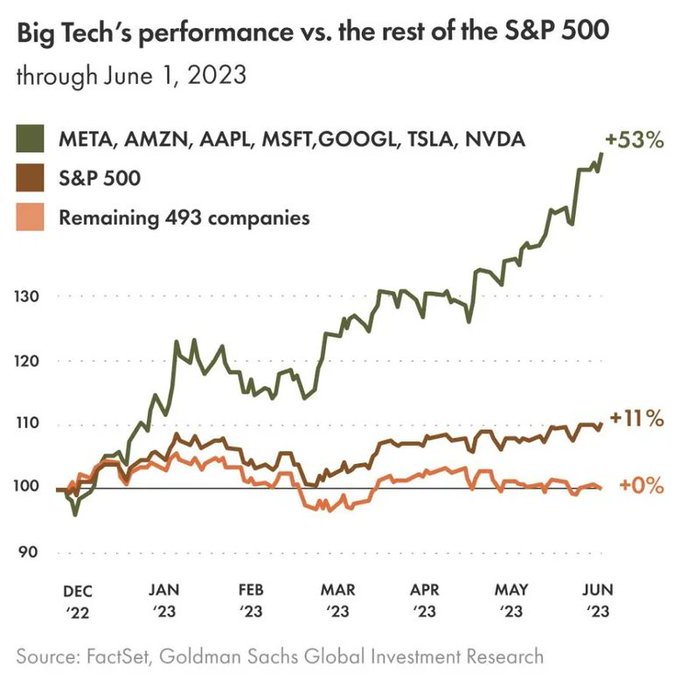

In last month’s post, we mentioned struggling with the idea of whether or not to follow our conviction of rotating from technology to cyclicals (large companies to smaller ones). We decided to wait for additional signs of the market rotation before making any substantive changes. It was a good move. With a week left to go, the Nasdaq 100 is up another 4.5% this month, extending a rally that has gone further than almost any analyst had predicted at the start of the year (why do we listen to these meteorologists?). So we’re in the same spot today as we were a month ago: Knowing that a pullback/decline is coming, but waiting until we see the turn before rebalancing portfolios since we believe this rally may have a little more juice left in it.

Without much change to our overall view, here’s a few research pieces of note from this month.

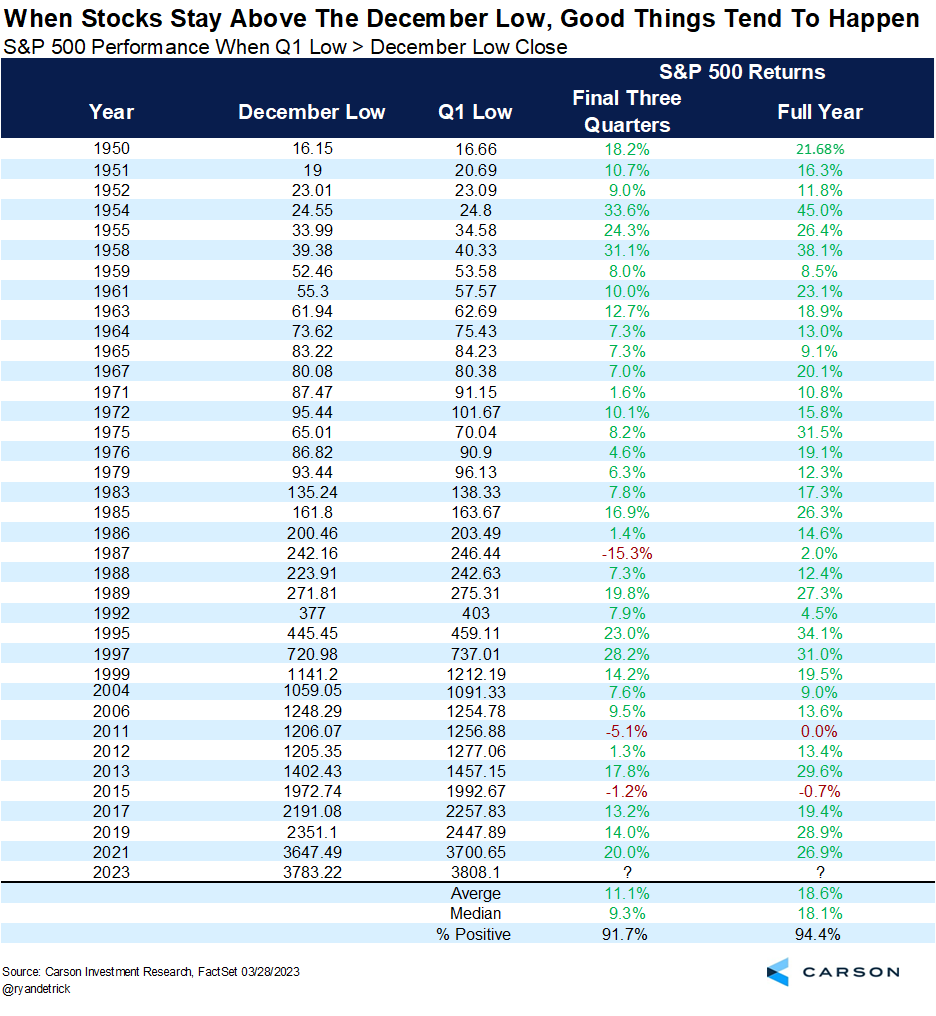

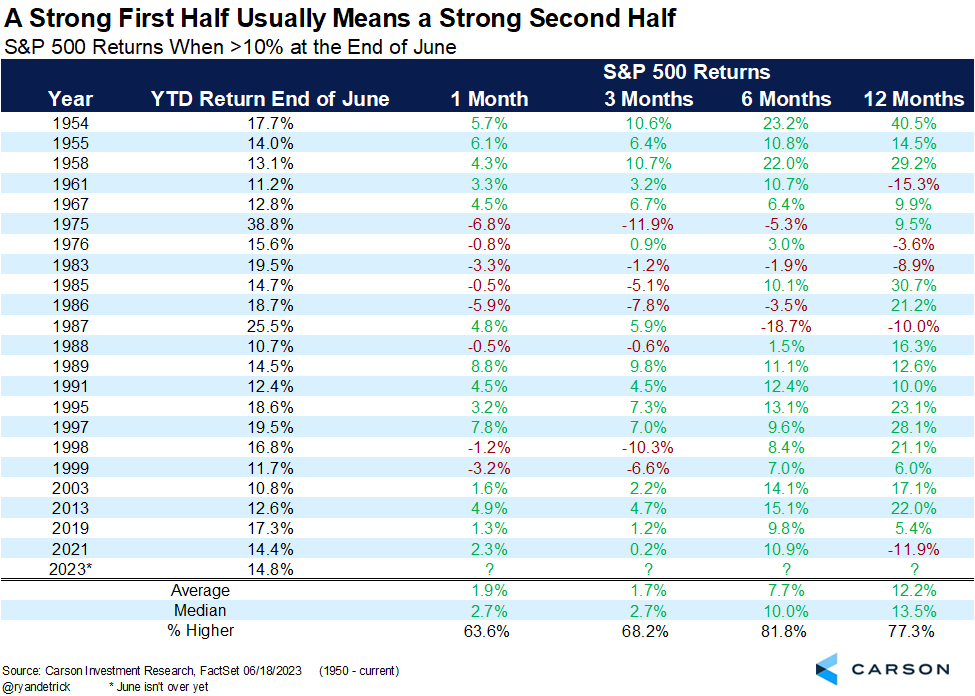

- The S&P 500 is up around 10% for the year. In the past 70 years, when the S&P is up 10% or more at the end of June, the final six months are up, on average, 82% of the time, with an average return of 7.7%. A good first half usually means a good second half.

2. The market has broadened out somewhat this month, but it’s still top heavy. This isn’t uncommon for the stock market, but it’s something to watch. Ideally we would want to see the “unloved” names participate in the rally to make us feel more comfortable (energy, real estate, small caps). Unfortunately, the market doesn’t care about our comfort level.

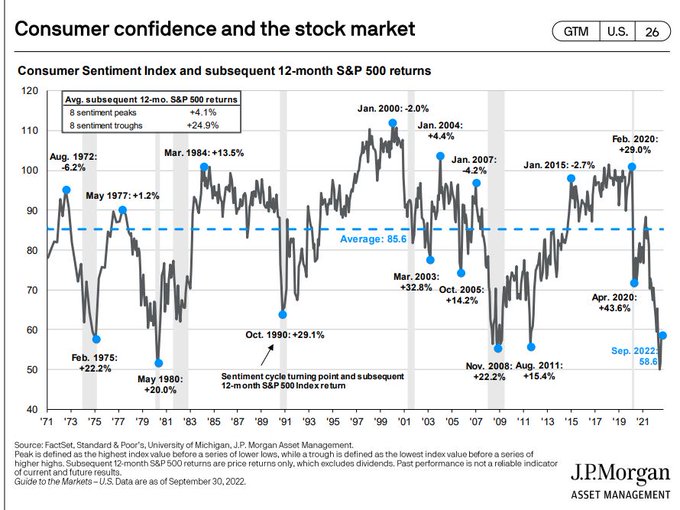

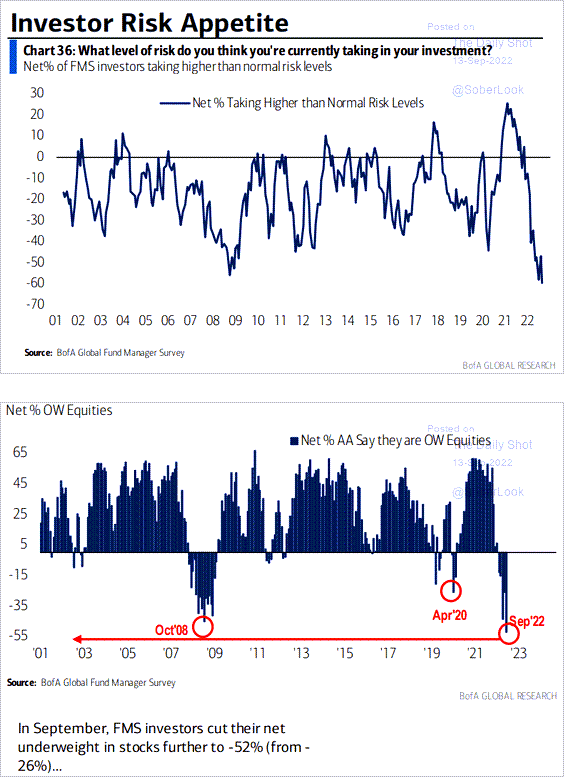

3. Adding to our feeling that the market may still have a little higher to go is the percentage of advisors that are still underweight equities (nervous and sitting in 5% treasuries). If the market were to continue to drift higher, it’s very possible that clients become fearful of missing out on the next bull market run (FOMO) and decide to jump back into the market on any pullback, large or small.

Summer has officially arrived in St. Louis with temperatures nearing 100 degrees this week. Hopefully, everyone is staying cool and as always, we’re here if you need anything.

– Adam