Hi all,

Since the end of Q3, the stock market overall has been on a tear. Small caps are up almost 6%, the S&P 500 is up almost 8%, and the technology-heavy Nasdaq 100 is up greater than 12% in the last 50 calendar days. The market continues to follow the traditionally bullish seasonal period from November to January, although the signs of weakness underlying this market could be a reason for pause in the short-term.

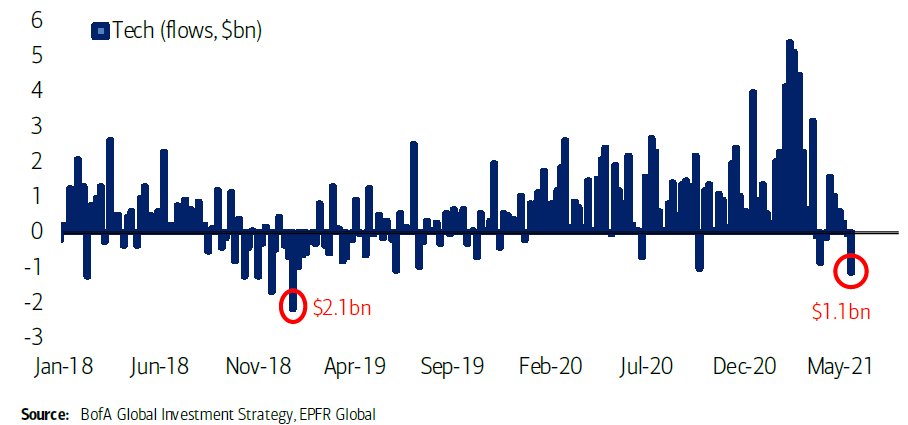

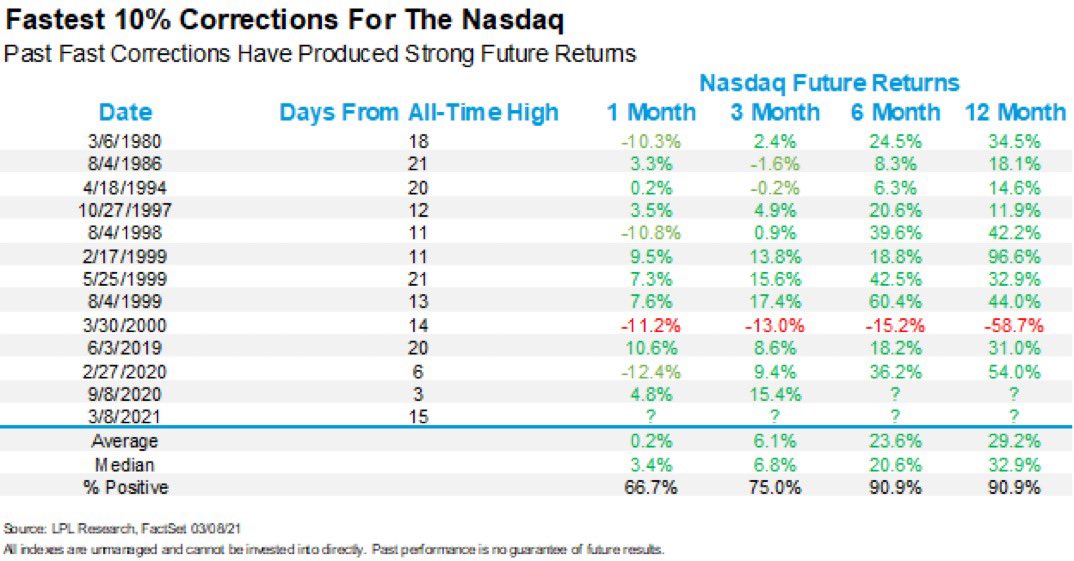

Our first roadblock is breadth. Breadth is a measure of how many stocks are advancing vs. how many stocks are declining. Obviously in a very healthy market, we would love for more advancers than decliners. For most of the month of October, the NYSE had substantially positive breadth meaning that the bulk of stocks in the NYSE universe were moving higher. Since the turn of the month, while indexes continued to make new highs, breadth began to roll over. Leadership has narrowed, and since the S&P 500 is a market cap-weighted index (the larger companies push and pull the indexes more than the little guys), the renewed strength of Apple, Amazon, Google, Tesla, etc., have masked some of the weakness under the hood. On November 18th, the Nasdaq saw the most number of stocks making new 52-week lows since March of 2020 (surprising given the all-time highs in the overall indexes). This typically resolves itself in one of two ways. Either the gravitational pull from the vast number of individual stocks begins to weigh on the larger names as well (entire market starts to pullback), or the individual stocks gain some strength into year-end and lead us for one more push toward higher highs on the S&P 500.

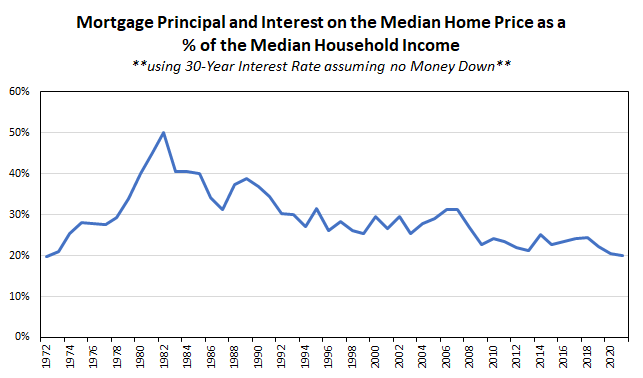

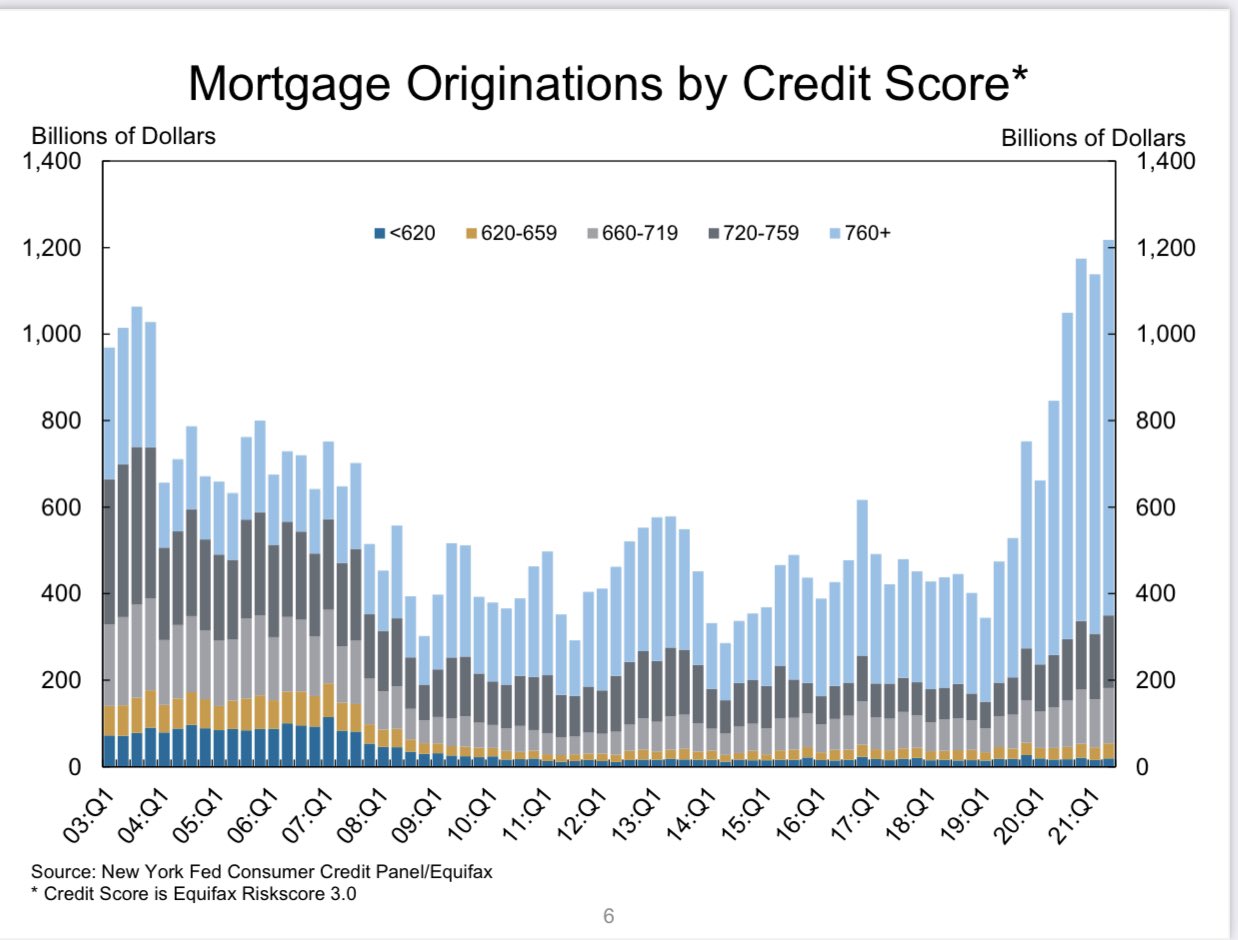

Other possible roadblocks are the re-emergence of COVID-related issues around the world (preventing supply chains from returning to normal), inflation-related concerns weighing on the overall consumer (although household debt as a percentage of assets remains at all-time lows), interest rate fears, and potential valuation issues with the S&P 500 now reaching a P/E multiple of around 25 times near year’s earnings.

While we continue to believe that valuation pressures and inflation concerns are overblown, they should not be dismissed outright. As of now, our outlook is for a pullback into late November and possibly into early-December and then a potential resumption of the rally into year-end. For those with cash on the sidelines, we recommend waiting for a better entry, and we are currently contemplating making additional substantial changes to our models for almost all clients going into next year, but we will reach out individually if/when we decide on what changes need to be made.

Happy Thanksgiving everyone!

– Adam